how much does illinois tax on paychecks

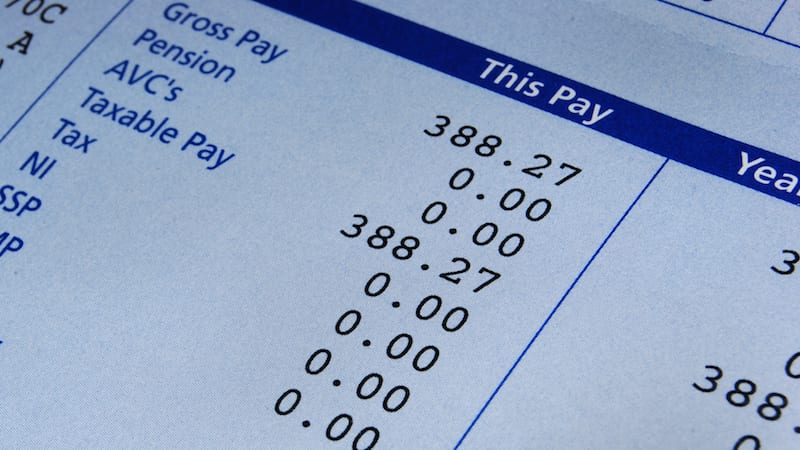

Personal Income Tax in Illinois. This calculator is a tool to estimate how much federal income tax will be withheld from your gross monthly check.

How To Fill Out Form W 4 In 2022 Adjusting Your Paycheck Tax Withholding

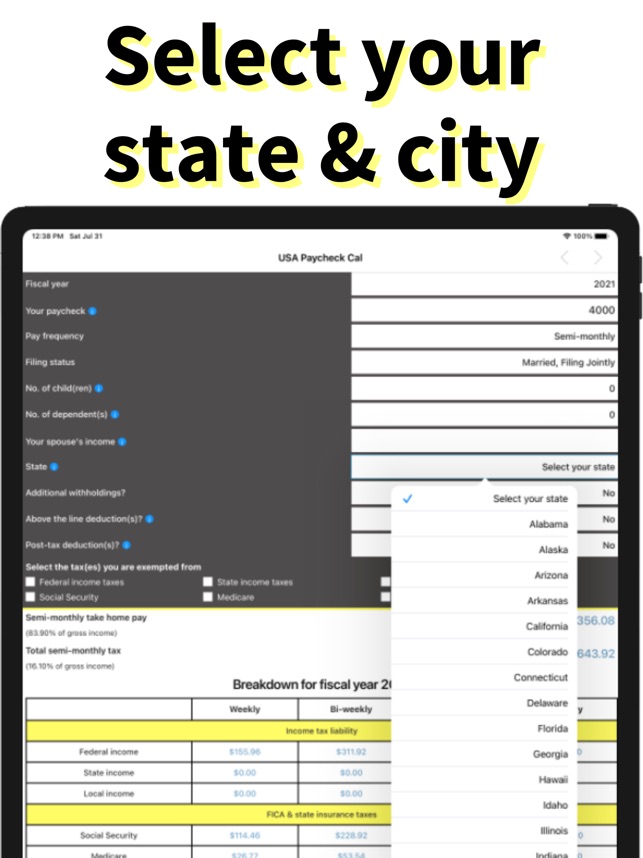

Illinois paycheck calculator Payroll Tax Salary Paycheck Calculator Illinois Paycheck Calculator Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or.

. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. 915 on portion of taxable income over 44470 up-to 89482. Employers in Illinois must deduct 145 percent from each employees paycheck.

According to the Illinois Department of Revenue all incomes are created equal. If you expect to owe 500 or more on April 15th you must pay your income tax to. If an employees hourly rate is 12 and they worked 38 hours in the pay period the employees gross pay for that paycheck is 45600 12 x 38.

How much does wisconsin take. Employees who file for. How Much Does Illinois Tax On Paychecks.

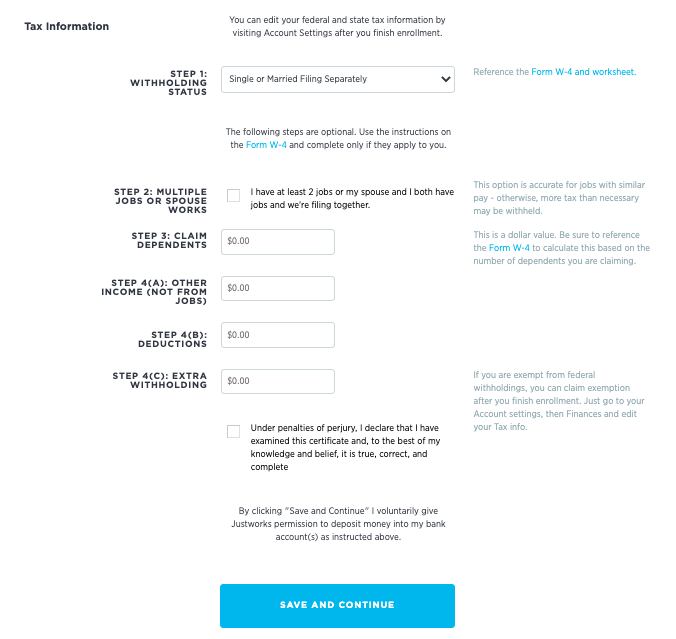

Rates are based on several factors including your industry and the amount of previous benefits paid. The Illinois bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Personal income tax in Illinois is a flat 495 for 2022.

Occupational Disability and Occupational Death Benefits are non-taxable. This Illinois hourly paycheck calculator is perfect for those who are paid on an hourly basis. Employers are responsible for deducting a flat income tax rate of 495 for all employees.

Yes Illinois residents pay state income tax. Unlike Social Security all earnings are subject to Medicare taxes. 505 on the first 44470 of taxable income.

Therefore fica can range between 153 and 162. The Illinois salary calculator will show you how much income tax is taken out of. As of January 1 2022 the Illinois unemployment tax rate ranges from 0725 to 7625.

How much tax is deducted from a paycheck Canada. Payroll benefits and everything else. The Illinois income tax was lowered from 5 to 375 in 2015.

No Illinois cities charge a local income tax on top of the. You exceed 12000 in withholding during a quarter it is your responsibility to begin to pay your Illinois withholding income tax semi-weekly in the following quarter the remainder of the year. Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state.

Although you might be tempted to take an employees earnings and multiply by 495 to come to a withholding amount its not that easy. The Illinois state income tax is a flat rate for all residents. How To Calculate Taxes Taken Out.

Previously the tax rate was raised from 3 to 5 in early 2011 as part of a statewide plan to reduce deficits. This 153 federal tax is made up of two parts.

Free Paycheck Calculator Hourly Salary Smartasset

Illinois Hiked Income Tax Is About To Affect Your Paycheck

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Government Will Take Almost Half Your Paycheck In 2013

Usa Paycheck Calculator On The App Store

Questions About My Paycheck Justworks Help Center

Why Illinois Is In Trouble 109 881 Public Employees With 100 000 Paychecks Cost Taxpayers 14b

14 States Approve Stimulus Checks As Inflation Continues To Rise Katv

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

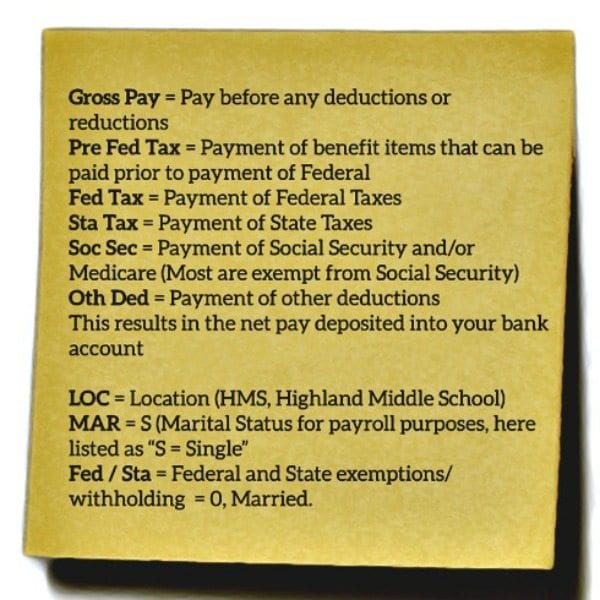

Understanding Your Teacher Paycheck We Are Teachers

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

How Much Would You Pay In Illinois Income Tax Under Pritzker Plan Across Illinois Il Patch

Maryland Adds Health Insurance Enrollment To Tax Filing Benefitspro

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Illinois Paycheck Calculator Smartasset

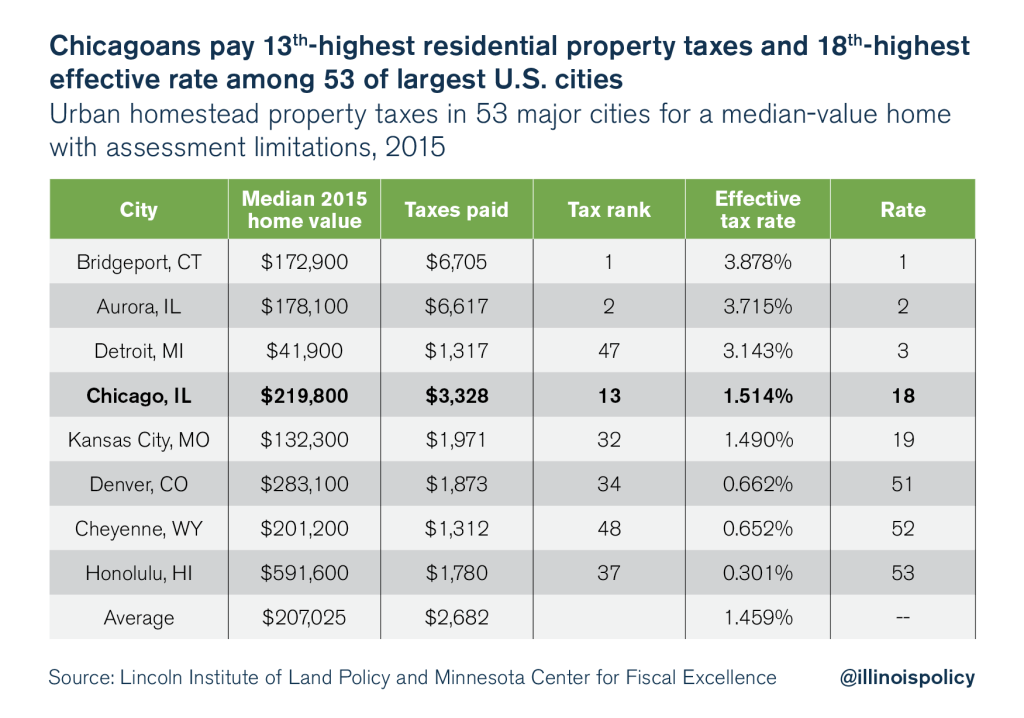

Illinois Is A High Tax State Illinois Policy

/cloudfront-us-east-1.images.arcpublishing.com/gray/JNMTSFRMONIZTGZVTHQULDKVWU.jpg)